28+ deduct interest on mortgage

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner.

Fixed Rate Mortgage Wikipedia

Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Mortgages taken out before October 13 1987 also known. Web If you took out your mortgage before Jan.

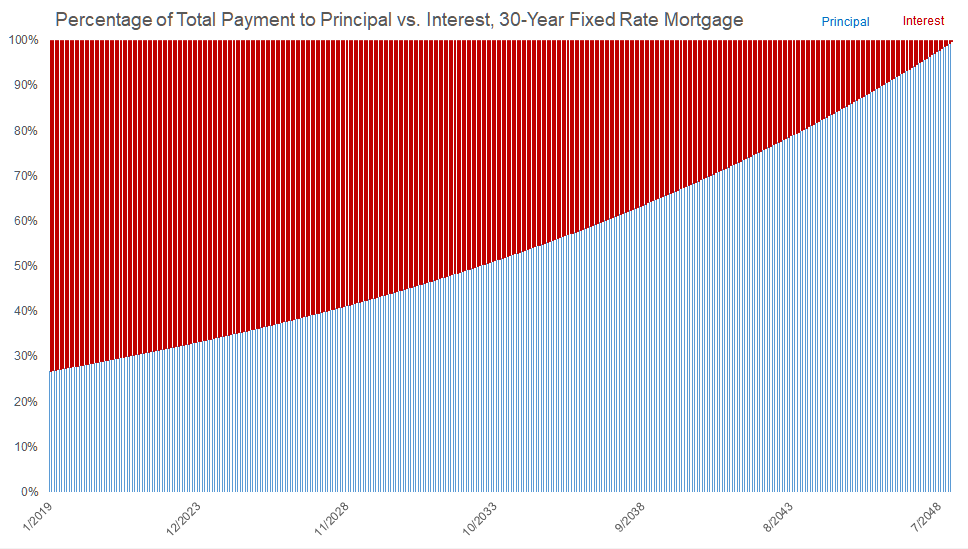

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Web 19 hours agoTo get an idea about how much you might pay in interest consider that the current 30-year fixed-rate mortgage of 689 on a 100000 loan will cost 658 per. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

However higher limitations 1 million 500000 if married. Mortgage interest paid on a home is also deductible up to certain. If you are single or married and.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 445 31 votes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtednessHowever higher. Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to. Homeowners who bought houses before.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web 16 hours agoThe entirety of the mortgage interest can be deducted if it fits into at least one of this three categories. Web Discussions with the taxpayer will tell you the interest is not deductible on Schedule Aat least not as mortgage interest. Web What counts as mortgage interest.

An investment interest deduction is. 1 2018 youre allowed to deduct the interest paid on up to 1 million of home acquisition debt plus 100000 of home.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Business Succession Planning And Exit Strategies For The Closely Held

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

28 Sample Installment Contract Templates In Pdf Ms Word

Mortgage Interest Deduction A Guide Rocket Mortgage

Apply For An Instant Car Loan Two Wheeler Loan Msme Loan Online At Sk Finance Limited Low Interest Rates Less Documents Easy To Apply

What Is The Mortgage Interest Deduction The Motley Fool

Should I Pay Off My Car Or Invest The Money Quora

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What S The Return On Mortgage Prepayments

G49371mmimage004 Jpg

Free Fillable Pay Stub Templates Word Excel Pdf Best Collections

May 2010 Association Of Dutch Businessmen

Tax Refunds Are The Best Part Of Tax Season What To Know

G49371mmimage003 Jpg

:max_bytes(150000):strip_icc()/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

How To Get The Lowest Mortgage Interest Rate Possible